A Beginner's Guide to Investing

After graduating from college back in 2004, I entered the workforce knowing full well that my chances of having a pension to rely on for a secure retirement were slim to none and that saving for retirement was imperative. As soon as I was eligible, I signed up for my company 401(k) plan and started saving for the future. That was a few jobs and retirement plans ago, but my approach to saving for the future remains the same: put money into savings and look for ways to improve my returns year over year while focusing on long term retirement goals. Along the way I've learned a lot about different investment options, strategies that I would like to share. This is the first article in a series about investing, so please check back for updates and share any topics that you would like to see covered or expanded upon.

As many of us in the workforce have realized, investing has become increasingly important over the years, as the future of social security becomes unknown. We all start at different levels of experience, but this article aims to give a broad overview of how to start thinking, preparing, and executing investment goals and strategies for those of us who are new to the world of investing. Let's start at the beginning.

As many of us in the workforce have realized, investing has become increasingly important over the years, as the future of social security becomes unknown. We all start at different levels of experience, but this article aims to give a broad overview of how to start thinking, preparing, and executing investment goals and strategies for those of us who are new to the world of investing. Let's start at the beginning.

1. EXAMINE YOUR INVESTMENT GOALS

The overall purpose in investing is to create wealth and security, over a period of time. But, before you jump right in, it is better to not only find out more about investing and how it all works, but also to determine what your goals are. What do you hope to achieve with your investments? Will you be funding a college education? Buying a home? Retiring? Before you invest a single penny, really think about what you hope to achieve with that investment. Knowing what your goal is will help you make smarter investment decisions along the way.

To listen to Ken Hevert, Fidelity Investments Senior Vice President discuss Investment Goals, click here:

To listen to Ken Hevert, Fidelity Investments Senior Vice President discuss Investment Goals, click here:

Too often, people invest money with dreams of becoming rich overnight. This is possible - but it is also rare. It is usually a very bad idea to start investing with hopes of becoming rich overnight. It is safer to invest your money in such a way that it will grow slowly over time, and be used for retirement or a child's education. However, if your investment goal is to get rich quick, you should learn as much about high-yield, short term investing as you possibly can before you invest.

2. INVESTING FOR RETIREMENT

People want to insure their futures, and they know that if they are depending on Social Security benefits, and in some cases retirement plans, that they may be in for a rude awakening when they no longer have the ability to earn a steady income. Investing is the answer to the unknowns of the future.

(Image courtesy NerdWallet)

Individual Retirement Account (IRA)

You can open an Individual Retirement Account (IRA). IRA's are quite popular because the money is not taxed until you withdraw the funds. You may also be able to deduct your IRA contributions from the taxes that you owe. An IRA can be opened at most banks, credit unions, and financial institutions.

(Image courtesy of 1080 Financial Group)

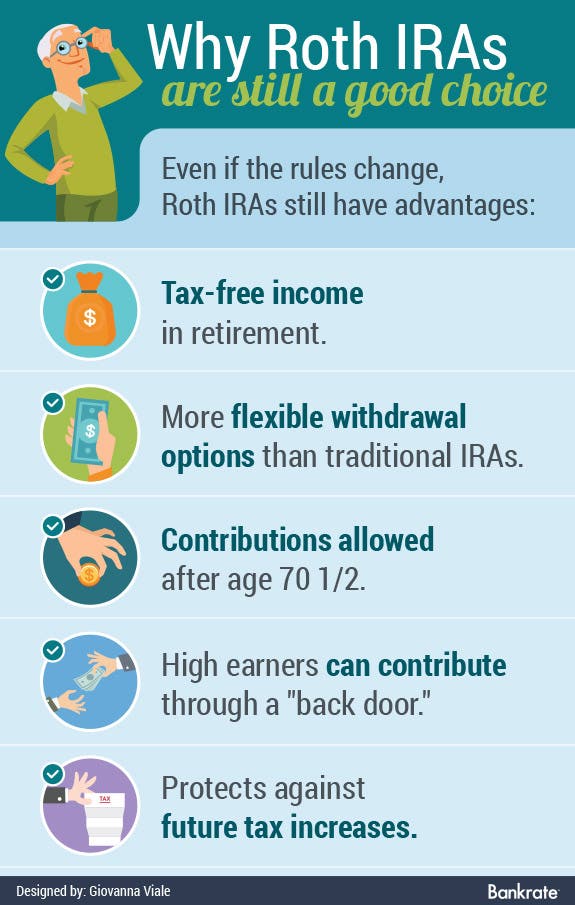

Roth IRA

A ROTH IRA is a different type of retirement account. With a Roth, you pay taxes on the money that you are investing in your account, but when you cash out, no federal taxes are owed. Roth IRA's can also be opened at most financial institutions.

(Image courtesy of Bankrate.com)

401(k) Retirement Accounts

Another popular type of retirement account is the 401(k). 401(k)'s are typically offered through employers, but you may be able to open a 401(k) on your own. You should speak with a financial planner or accountant to help you with this.

To watch an overview of How to Invest in Your 401(k) by Time Money, click here:

To watch an overview of How to Invest in Your 401(k) by Time Money, click here:

(Image courtesy of Austin Benefits Group)

Self-employed Plans

The Keogh Plan is another type of IRA that is suitable for self-employed people. Self-employed small business owners may also be interested in Simplified Employee Pension Plans (SEP). This is another type of Keogh Plan that people typically find easier to administer than a regular Keogh Plan.

To watch an overview of Retirement Planning for the Self-Employed by Investopedia, click here"

To watch an overview of Retirement Planning for the Self-Employed by Investopedia, click here"

3. LONG TERM INVESTMENTS FOR THE FUTURE

You may have been saving money in a low interest savings account over the years. Now, you want to see that money grow at a faster pace. Perhaps you've inherited money or realized some other type of windfall, and you need a way to make that money grow. Again, investing is the answer. You can easily invest your money in way that are very safe, which will show a decent return over a long period of time.

To watch an interview with famed investor Warren Buffett discussing long term investments, click here:

Bonds

First consider Bonds. There are various types of bonds that you can purchase. Bonds are similar to Certificates of Deposit (CD). Instead of being issued by banks, however, bonds are issued by the Government. Depending on the type of bonds that you buy, your initial investment may double over a specific period of time.

Mutual Funds

Mutual Funds are also relatively safe. Mutual funds exist when a group of investors put their money together to buy stocks, bonds, or other investments. A fund manager typically decides how the money will be invested. All you need to do is find a reputable, qualified broker who handles mutual funds, and he or she will invest your money, along with other client's money. Mutual funds are a bit riskier than bonds.

ETFs

Exchange Traded Funds (ETFs) are uniquely structured investment products that track indexes, or baskets of assets, including stocks, bonds, currencies, real estate and commodities. Because ETFs can cover a broad range of assets, they offer investors diversity from a single investment. When you purchase ETF shares, you are buying shares of a portfolio that tracks the yield and performance of its underlying asset(s). (Investopedia)

To watch an overview of investing in ETFs by TDAmeritrade, click here:

Stocks

Stocks are another vehicle for long term investments. Shares of stocks are essentially shares of ownership in the company you are investing in. When the company does well financially, the value of your stock rises. However, if a company is doing poorly, your stock value drops. Stocks, of course, are even riskier than Mutual Funds. Even though there is a greater amount of risk, you can still purchase stock in sound companies like Apple (AAPL) and Johnson & Johnson (JNJ) and sleep at night knowing that your money is relatively safe.

To watch an overview of Investing Basics on Stocks by TDAmeritrade, click here:

You may have been saving money in a low interest savings account over the years. Now, you want to see that money grow at a faster pace. Perhaps you've inherited money or realized some other type of windfall, and you need a way to make that money grow. Again, investing is the answer. You can easily invest your money in way that are very safe, which will show a decent return over a long period of time.

To watch an interview with famed investor Warren Buffett discussing long term investments, click here:

Bonds

First consider Bonds. There are various types of bonds that you can purchase. Bonds are similar to Certificates of Deposit (CD). Instead of being issued by banks, however, bonds are issued by the Government. Depending on the type of bonds that you buy, your initial investment may double over a specific period of time.

(Image courtesy of UC Retirement Benefits)

(Image courtesy of Standard Life)

Mutual Funds

Mutual Funds are also relatively safe. Mutual funds exist when a group of investors put their money together to buy stocks, bonds, or other investments. A fund manager typically decides how the money will be invested. All you need to do is find a reputable, qualified broker who handles mutual funds, and he or she will invest your money, along with other client's money. Mutual funds are a bit riskier than bonds.

ETFs

Exchange Traded Funds (ETFs) are uniquely structured investment products that track indexes, or baskets of assets, including stocks, bonds, currencies, real estate and commodities. Because ETFs can cover a broad range of assets, they offer investors diversity from a single investment. When you purchase ETF shares, you are buying shares of a portfolio that tracks the yield and performance of its underlying asset(s). (Investopedia)

To watch an overview of investing in ETFs by TDAmeritrade, click here:

Stocks

Stocks are another vehicle for long term investments. Shares of stocks are essentially shares of ownership in the company you are investing in. When the company does well financially, the value of your stock rises. However, if a company is doing poorly, your stock value drops. Stocks, of course, are even riskier than Mutual Funds. Even though there is a greater amount of risk, you can still purchase stock in sound companies like Apple (AAPL) and Johnson & Johnson (JNJ) and sleep at night knowing that your money is relatively safe.

To watch an overview of Investing Basics on Stocks by TDAmeritrade, click here:

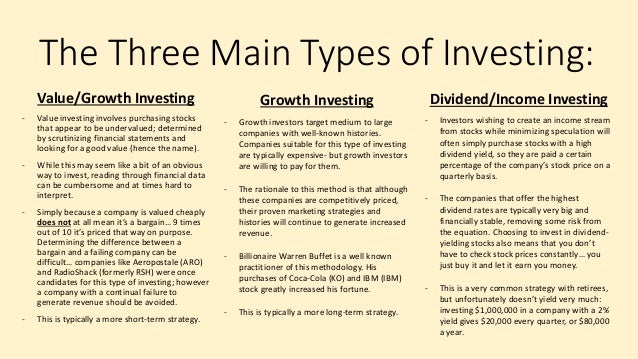

4. INVESTING STRATEGY

An Investment Strategy is basically a plan for investing your money in various types of investments that will help you meet your financial goals in a specific amount of time. Each type of investment contains individual investments that you must choose from. A clothing store sells clothes - but those clothes consist of shirts, pants, dresses, skirts, undergarments, etc. The stock market is a type of investment, but it contains different types of stocks, which all contain different companies that you can invest in.

An Investment Strategy is basically a plan for investing your money in various types of investments that will help you meet your financial goals in a specific amount of time. Each type of investment contains individual investments that you must choose from. A clothing store sells clothes - but those clothes consist of shirts, pants, dresses, skirts, undergarments, etc. The stock market is a type of investment, but it contains different types of stocks, which all contain different companies that you can invest in.

(Image courtesy of Bankrate)

(Image courtesy of Wells Fargo)

(Image courtesy of SlideShare)

5. DETERMINE YOUR RISK TOLERANCE

Each individual has a risk tolerance that should not be ignored. Any good stock broker or financial planner knows this, and they should make the effort to help you determine what your risk tolerance is. Then, they should work with you to find investments that do not exceed your risk tolerance.

Determining one's risk tolerance involves several different things. First, you need to know how much money you have to invest, and what your investment and financial goals are.

For instance, if you plan to retire in ten years, and you've not saved a single penny towards that end, you need to have a high risk tolerance - because you will need to do some aggressive and risky investing in order to reach your financial goal.

Conversely, if you are in your early twenties and you want to start investing for your retirement, your risk tolerance will be low. You can afford to watch your money grow slowly over time.

To watch a brief overview of How to Determine Risk Tolerance by US Bank, click here:

Each individual has a risk tolerance that should not be ignored. Any good stock broker or financial planner knows this, and they should make the effort to help you determine what your risk tolerance is. Then, they should work with you to find investments that do not exceed your risk tolerance.

Determining one's risk tolerance involves several different things. First, you need to know how much money you have to invest, and what your investment and financial goals are.

For instance, if you plan to retire in ten years, and you've not saved a single penny towards that end, you need to have a high risk tolerance - because you will need to do some aggressive and risky investing in order to reach your financial goal.

Conversely, if you are in your early twenties and you want to start investing for your retirement, your risk tolerance will be low. You can afford to watch your money grow slowly over time.

To watch a brief overview of How to Determine Risk Tolerance by US Bank, click here:

(Image courtesy of ProNvest)

Now that we've covered the basics of investing, the next step is to look at each area in more detail to see how best we can apply these strategies. Please check back for updates and share any topics that you would like to see covered or expanded upon.

Comments

Post a Comment