Top 10 Tips for Personal Finance (2018)

Whether you're starting your first job or already in the workforce, it's always a good idea to have a plan of action when it comes to your personal finances. Managing your own money can be confusing and complicated when you're first getting started, trust me, we've all been there. That's where the internet can be a huge asset. At least once a year I like to take a step back and look at my our family budget and see where we can make improvements. It's really easy to get off track sometimes for various reasons, but it can also be just as easy to make a few adjustments to get back in the right direction. Little things like packing lunches for the week versus eating out for lunch can add up to real savings.

COFFEE, SNACK, LUNCH IN THE OFFICE VS EATING SNACKS, COFFEE, AND LUNCH FROM THE CAFE

This article is a compilation of Personal Finance advise from reputable sources from around the web. Feel free to look at some of the articles that are linked below to get some additional information on important money matters. Let's take a look at the Top 10 Tips for Personal Finance from around the web:

To watch a video on How to Budget by Mint.com, click here:

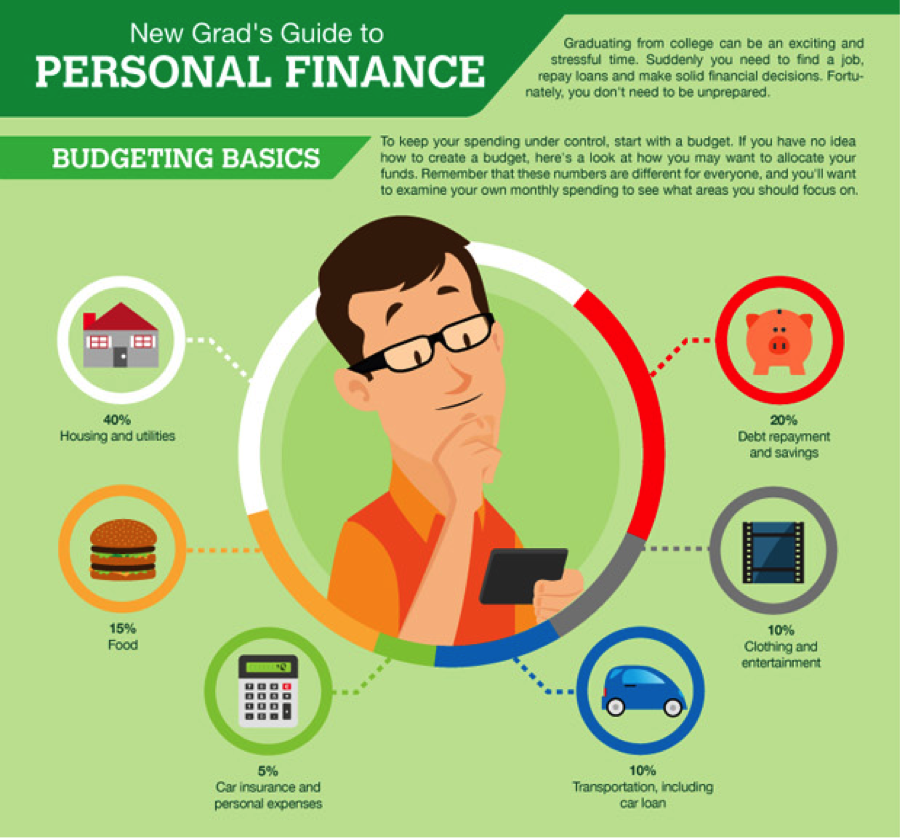

1. Know How to Budget

The backbone of a sound financial plan is a budget. Budgeting helps you make the most of your money and reach your financial goals.

To create a budget, you first need to know how much money you're bringing in. Some people choose to use their net income as their starting figure, while others like to use their gross income. Then, list all of your expenses so you know where your money is going. After that, track your spending for a month and see how it compares with your budgeted amounts. This will allow you to look for places where you can cut back on spending.

Once you have a budget in place, stick to it. (Bankrate)

2. Set Up an Emergency Fund

One thing you count on is that, at some point, you'll have an unexpected expense. An emergency fund can help defray the impact of the unforeseen on your monthly budget. Aim to set aside six months' worth of living expenses, but if that seems insurmountable, start with a smaller goal. At minimum, try to keep $1000 in your emergency fund, building it up as your available income increases. Remember that an emergency fund is for emergencies only; if necessary, make it difficult to access the funds so that you're not tempted to use them for non-emergencies. (Quicken)

3. Manage Your Debt to Stay Out of Debt

"Without a strategic debt management plan, you will likely continue to accrue debt which puts you further behind and makes it harder to escape. Debt management includes strategically paying down the most expensive debt first, like credit card debt, then personal loans, then student loans, and then housing debt. However, debt management is also just as much about avoiding future debt and looking for areas to cut back spending or at least, spend smarter. If you find yourself buying coffee every day or eating out at lunch, think about packing lunches or buying a coffee machine, which could save you money in the long term."

-Ajamu Loving, PhD, Professor of Finance. (Forbes)

4. Start Saving for Retirement Now

Just as you headed off to kindergarten with your parents' hope to prepare you for success in a world that seemed eons away, you need to prepare for your retirement well in advance. Because of the way compound interest works, the sooner you start saving, the less principal you'll have to invest to end up with the amount you need to retire and the sooner you'll be able to call working an "option" rather than a "necessity".

Company-sponsored retirement plans are a particularly great choice because you get to put in pre-tax dollars and the contribution limits tend to be high (much more than you can contribute to an individual retirement plan). Also, companies will often match part of your contribution, which is like getting free money. (Investopedia)

5. Live Simply and Be Frugal

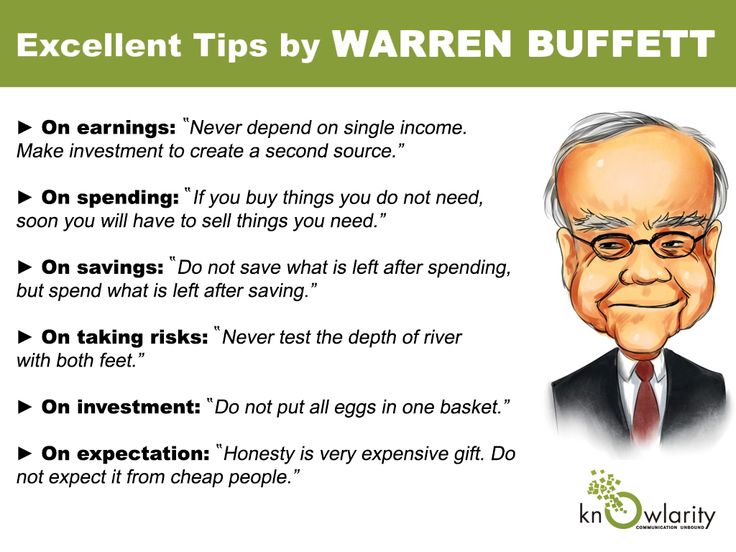

Most people don't associate billionaires with penny-pinching, but that's how famed investor and billionaire Warren Buffett approaches his personal finances. Buffett bought a relatively modest house back in 1958 for just $31,000, which was around $275,000 in [2017] dollars, and he continues to live in it to this day. For context, the median home price in July [2017] was $313,700.

Buffett has summarized his views on success and happiness like this:

"Success is really doing what you love and doing it well. It's as simple as that. Really getting to do what you love to do everyday -- that's really the ultimate luxury . . . your standard of living is not equal to your cost of living."

Buffett also holds on to his vehicles for a long time, as does Wal-Mart found Sam Walton. And IKEA founder and billionaire Ingvar Kamprad once shared why having lots of money doesn't mean you should indulge yourself to no end:

"I'm a bit tight with money, but so what? I look at the money I'm about to spend on myself and ask myself if IKEA's customers can afford it . . . I could regularly travel first class, but having money in abundance doesn't seem like a good reason to waste it." (The Motley Fool)

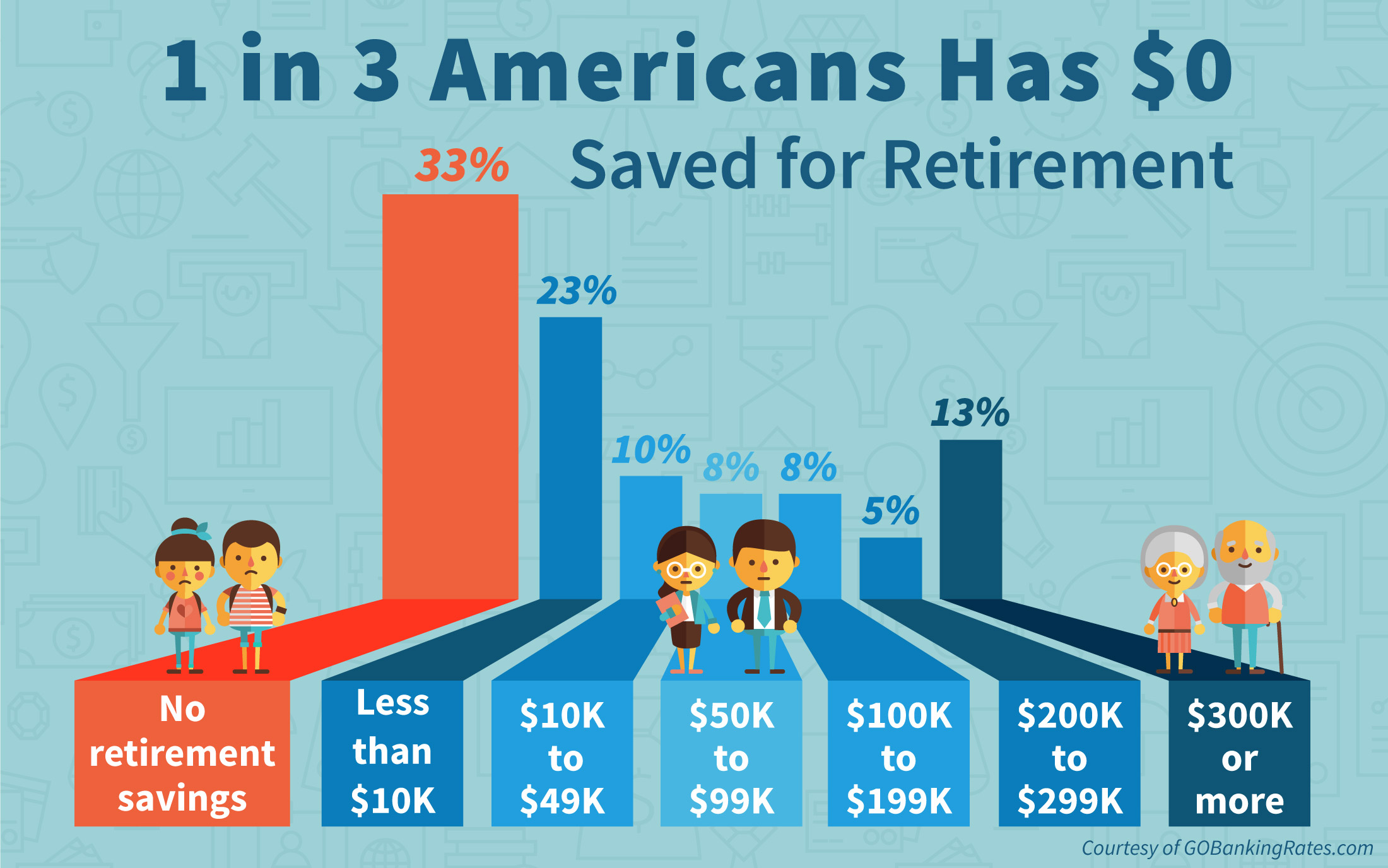

6. Working Forever Isn't a Retirement Plan

When you hit your 40s, you should understand that saving for retirement is a critical part of your financial strategy. If you're behind on retirement savings at this point, consider ratcheting up how much money you're contributing to your retirement accounts.

The maximum contribution amount for 401(k) is $18,000 in 2017 and $18,500 in 2018. Outside of your workplace plan, you can contribute an additional $5,500 to an IRA.

Unsure if you're on track with your retirement savings? Check out Bankrate's retirement calculator to see what it will take to reach a secure retirement. (Bankrate)

7. Guard Your Wealth

If you want to make sure that all of your hard-earned money doesn't vanish, you'll need to take steps to protect it. If you rent, get renter's insurance to protect the contents of your place from events like burglary or fire. Disability-income insurance protects your greatest asset - the ability to earn an income - by providing you with a steady income if you ever become unable to work for an extended period of time due to illness or injury.

If you want help managing your money, find a fee-only financial planner to provide unbiased advice that's in your best interest, rather than a commission-based financial advisor, who earns money when you sign up with the investments his or her company backs. You'll also want to protect your money from taxes, which is easy to do with a retirement account, and inflation, which you can do by making sure that all of your money is earning interest through vehicles like high-interest savings accounts, money market funds, CDs, stocks, bonds, and mutual funds. (Investopedia)

8. Have a Long-Term Investing Strategy

There's no better way to build up your wealth than let your money earn even more money for you by investing in stock or index funds. John Bogle, the founder of The Vanguard Group and the creator of index mutual funds, says many things will try to distract you from your long-term goals, but you have to stay the course: "Do not let false hope, fear and greed crowd out good investment judgment. If you focus on the long term and stick with your plan, success should be yours."

Bogle's words aren't puffery, either. The index funds offered by his company are some of the easiest ways to build long-term wealth because of thier historic 10% annual returns and low expense ratios. (The Motley Fool)

9. Create a Healthcare Contingency Plan

No one likes to think about it, but at some point you might be unable to make your own healthcare decisions. The best time to address this contingency is long before you're actually in that situation. The typical documents you'll need are a healthcare power of attorney, which allows a certain person to make medical decisions on your behalf, and a living will, which outlines your wishes for care in various medical situations. Check the laws in your state, since some laws require a specific language or format for healthcare proxies.

Also consider long-term care insurance. "Its'a gamble," admits Holland, "and it's not right for everyone, but if you need it, you'll be glad you have it." In general, the wealthy and the poor are less likely to benefit from a long-term care policy. For those of moderate means, a policy can allow them to receive care without significantly impacting their net worth. (Quicken)

10. Credit is a Tool

At this stage, you're likely dealing with a mortgage, car loans, and children entering college. "A healthy credit score is vitally important to you," says Bruce McClary, Vice President of Communication at the National Foundation for Credit Counseling.

If you examine your credit score and don't like what you see, chances are you haven't paid your bills on time. "Paying on time counts for about one-third of your score," McClary says.

Committing to paying everything on time is the obvious solution to this problem.

It also pays to check your credit report carefully for credit killers, such as identity theft or inaccurate reports. Check your credit report for free at myBankrate.

Finally, at your age, work to pay off debt and keep balances low, he says. "Focus on power-paying those balances and getting rid of them as fast as possible." (Bankrate)

BONUS:

Do Something for Your Kids

"Think about what small thing you can do in [2018] that will have a huge impact for your children 10 or 15 years from now. Maybe it's funding a 529 account for college or the new 529 ABLE accounts for children with disabilities. Perhaps it's establishing a trust or funding a small investment account so they have a safety net after college. Small acts today can be lifesavers for your kids when they become adults. Plus, it may avoid the likelihood of having them move into your basement when they're 30."

-Adam Beck, JD, Professor of Health Insurance (Forbes)

Buy a Life Insurance Policy

Choosing life insurance involves a complex decision between term, whole and universal life, with variable or fixed options. Determining how much life insurance you need can also be complicated, although having a good handle on your assets and liabilities can help with the calculation. If you have a spouse, children or others who depend on your income. However, don't let the potential difficulty keep you from purchasing insurance, advises Holland. "The last thing your loved ones need is to worry about how they're going to pay the bills while they're still dealing with your loss." (Quicken)

Make Your Final Arrangements

Planning your own funeral might make you a little uncomfortable, but it can save your loved ones time, stress and money when you're gone. "A preplanned and prepaid funeral can ease the burden on survivors," Holland explains. Your family won't have to worry about choosing between gray silk or white satin when they're in the middle of mourning, and they'll be sure your wishes are being met. (Quicken)

Protect Your Heirs' Inheritance

An estate plan is an essential part of a personal financial plan. The complexity of your estate plan will depend on your situation, but a basic plan typically includes a will and a living trust. A will provides instructions for the distribution of your assets after your death and names a guardian for your minor children. If you only have a will, however, your estate might still go through probate, which can take several months and drain a portion of the assets.

A living trust avoids probate, lets you provide specific instructions for the distribution of your assets and names the person who will pay your final bills, deliver inheritances to your heirs and close out the estate. Avoid a common mistake people make with living trusts, however. "You must fund the trust, by retitling assets such as bank accounts, investments, personal property and real estate into then name of the trust," warns Holland. "Otherwise, those items will still need to go through probate, and you lose the advantage of the trust." (Quicken)

Was this article helpful? Please let me know in the comments section.

COFFEE, SNACK, LUNCH IN THE OFFICE VS EATING SNACKS, COFFEE, AND LUNCH FROM THE CAFE

This article is a compilation of Personal Finance advise from reputable sources from around the web. Feel free to look at some of the articles that are linked below to get some additional information on important money matters. Let's take a look at the Top 10 Tips for Personal Finance from around the web:

To watch a video on How to Budget by Mint.com, click here:

1. Know How to Budget

The backbone of a sound financial plan is a budget. Budgeting helps you make the most of your money and reach your financial goals.

To create a budget, you first need to know how much money you're bringing in. Some people choose to use their net income as their starting figure, while others like to use their gross income. Then, list all of your expenses so you know where your money is going. After that, track your spending for a month and see how it compares with your budgeted amounts. This will allow you to look for places where you can cut back on spending.

Once you have a budget in place, stick to it. (Bankrate)

2. Set Up an Emergency Fund

One thing you count on is that, at some point, you'll have an unexpected expense. An emergency fund can help defray the impact of the unforeseen on your monthly budget. Aim to set aside six months' worth of living expenses, but if that seems insurmountable, start with a smaller goal. At minimum, try to keep $1000 in your emergency fund, building it up as your available income increases. Remember that an emergency fund is for emergencies only; if necessary, make it difficult to access the funds so that you're not tempted to use them for non-emergencies. (Quicken)

3. Manage Your Debt to Stay Out of Debt

"Without a strategic debt management plan, you will likely continue to accrue debt which puts you further behind and makes it harder to escape. Debt management includes strategically paying down the most expensive debt first, like credit card debt, then personal loans, then student loans, and then housing debt. However, debt management is also just as much about avoiding future debt and looking for areas to cut back spending or at least, spend smarter. If you find yourself buying coffee every day or eating out at lunch, think about packing lunches or buying a coffee machine, which could save you money in the long term."

-Ajamu Loving, PhD, Professor of Finance. (Forbes)

4. Start Saving for Retirement Now

Just as you headed off to kindergarten with your parents' hope to prepare you for success in a world that seemed eons away, you need to prepare for your retirement well in advance. Because of the way compound interest works, the sooner you start saving, the less principal you'll have to invest to end up with the amount you need to retire and the sooner you'll be able to call working an "option" rather than a "necessity".

Company-sponsored retirement plans are a particularly great choice because you get to put in pre-tax dollars and the contribution limits tend to be high (much more than you can contribute to an individual retirement plan). Also, companies will often match part of your contribution, which is like getting free money. (Investopedia)

5. Live Simply and Be Frugal

Most people don't associate billionaires with penny-pinching, but that's how famed investor and billionaire Warren Buffett approaches his personal finances. Buffett bought a relatively modest house back in 1958 for just $31,000, which was around $275,000 in [2017] dollars, and he continues to live in it to this day. For context, the median home price in July [2017] was $313,700.

Buffett has summarized his views on success and happiness like this:

"Success is really doing what you love and doing it well. It's as simple as that. Really getting to do what you love to do everyday -- that's really the ultimate luxury . . . your standard of living is not equal to your cost of living."

Buffett also holds on to his vehicles for a long time, as does Wal-Mart found Sam Walton. And IKEA founder and billionaire Ingvar Kamprad once shared why having lots of money doesn't mean you should indulge yourself to no end:

"I'm a bit tight with money, but so what? I look at the money I'm about to spend on myself and ask myself if IKEA's customers can afford it . . . I could regularly travel first class, but having money in abundance doesn't seem like a good reason to waste it." (The Motley Fool)

To watch a video about the 3 Principles of Personal Finance by Mint.com, click here:

6. Working Forever Isn't a Retirement Plan

When you hit your 40s, you should understand that saving for retirement is a critical part of your financial strategy. If you're behind on retirement savings at this point, consider ratcheting up how much money you're contributing to your retirement accounts.

The maximum contribution amount for 401(k) is $18,000 in 2017 and $18,500 in 2018. Outside of your workplace plan, you can contribute an additional $5,500 to an IRA.

Unsure if you're on track with your retirement savings? Check out Bankrate's retirement calculator to see what it will take to reach a secure retirement. (Bankrate)

7. Guard Your Wealth

If you want to make sure that all of your hard-earned money doesn't vanish, you'll need to take steps to protect it. If you rent, get renter's insurance to protect the contents of your place from events like burglary or fire. Disability-income insurance protects your greatest asset - the ability to earn an income - by providing you with a steady income if you ever become unable to work for an extended period of time due to illness or injury.

If you want help managing your money, find a fee-only financial planner to provide unbiased advice that's in your best interest, rather than a commission-based financial advisor, who earns money when you sign up with the investments his or her company backs. You'll also want to protect your money from taxes, which is easy to do with a retirement account, and inflation, which you can do by making sure that all of your money is earning interest through vehicles like high-interest savings accounts, money market funds, CDs, stocks, bonds, and mutual funds. (Investopedia)

8. Have a Long-Term Investing Strategy

There's no better way to build up your wealth than let your money earn even more money for you by investing in stock or index funds. John Bogle, the founder of The Vanguard Group and the creator of index mutual funds, says many things will try to distract you from your long-term goals, but you have to stay the course: "Do not let false hope, fear and greed crowd out good investment judgment. If you focus on the long term and stick with your plan, success should be yours."

Bogle's words aren't puffery, either. The index funds offered by his company are some of the easiest ways to build long-term wealth because of thier historic 10% annual returns and low expense ratios. (The Motley Fool)

9. Create a Healthcare Contingency Plan

No one likes to think about it, but at some point you might be unable to make your own healthcare decisions. The best time to address this contingency is long before you're actually in that situation. The typical documents you'll need are a healthcare power of attorney, which allows a certain person to make medical decisions on your behalf, and a living will, which outlines your wishes for care in various medical situations. Check the laws in your state, since some laws require a specific language or format for healthcare proxies.

Also consider long-term care insurance. "Its'a gamble," admits Holland, "and it's not right for everyone, but if you need it, you'll be glad you have it." In general, the wealthy and the poor are less likely to benefit from a long-term care policy. For those of moderate means, a policy can allow them to receive care without significantly impacting their net worth. (Quicken)

10. Credit is a Tool

At this stage, you're likely dealing with a mortgage, car loans, and children entering college. "A healthy credit score is vitally important to you," says Bruce McClary, Vice President of Communication at the National Foundation for Credit Counseling.

If you examine your credit score and don't like what you see, chances are you haven't paid your bills on time. "Paying on time counts for about one-third of your score," McClary says.

Committing to paying everything on time is the obvious solution to this problem.

It also pays to check your credit report carefully for credit killers, such as identity theft or inaccurate reports. Check your credit report for free at myBankrate.

Finally, at your age, work to pay off debt and keep balances low, he says. "Focus on power-paying those balances and getting rid of them as fast as possible." (Bankrate)

BONUS:

Do Something for Your Kids

"Think about what small thing you can do in [2018] that will have a huge impact for your children 10 or 15 years from now. Maybe it's funding a 529 account for college or the new 529 ABLE accounts for children with disabilities. Perhaps it's establishing a trust or funding a small investment account so they have a safety net after college. Small acts today can be lifesavers for your kids when they become adults. Plus, it may avoid the likelihood of having them move into your basement when they're 30."

-Adam Beck, JD, Professor of Health Insurance (Forbes)

Buy a Life Insurance Policy

Choosing life insurance involves a complex decision between term, whole and universal life, with variable or fixed options. Determining how much life insurance you need can also be complicated, although having a good handle on your assets and liabilities can help with the calculation. If you have a spouse, children or others who depend on your income. However, don't let the potential difficulty keep you from purchasing insurance, advises Holland. "The last thing your loved ones need is to worry about how they're going to pay the bills while they're still dealing with your loss." (Quicken)

Make Your Final Arrangements

Planning your own funeral might make you a little uncomfortable, but it can save your loved ones time, stress and money when you're gone. "A preplanned and prepaid funeral can ease the burden on survivors," Holland explains. Your family won't have to worry about choosing between gray silk or white satin when they're in the middle of mourning, and they'll be sure your wishes are being met. (Quicken)

Protect Your Heirs' Inheritance

An estate plan is an essential part of a personal financial plan. The complexity of your estate plan will depend on your situation, but a basic plan typically includes a will and a living trust. A will provides instructions for the distribution of your assets after your death and names a guardian for your minor children. If you only have a will, however, your estate might still go through probate, which can take several months and drain a portion of the assets.

A living trust avoids probate, lets you provide specific instructions for the distribution of your assets and names the person who will pay your final bills, deliver inheritances to your heirs and close out the estate. Avoid a common mistake people make with living trusts, however. "You must fund the trust, by retitling assets such as bank accounts, investments, personal property and real estate into then name of the trust," warns Holland. "Otherwise, those items will still need to go through probate, and you lose the advantage of the trust." (Quicken)

Was this article helpful? Please let me know in the comments section.

Hey, gratitude for sharing these personal finance tips here. For every person out there, personal financial planning is a must have aspect because unimagined things can happen at any moment and to tackle those, savings are mandatory. I personally like to invest in stock market and it helps me generate quite good income.

ReplyDeleteThe Edu and Gov domains tend to have a lot of security measures because they contain a lot of personal information about the citizens at times. The benefit of the gov and edu domain names is that because of their safety measures one can rely on them for their secure platforms. new jersey attorney search

ReplyDeleteInteresting work and great tips about finance. I really enjoyed reading your post. Thank you so much for sharing this valuable information. Get More Information Visit Here: Oracle Financial Group

ReplyDeleteThank you for helping people get the information they need. Great stuff as usual. Keep up the great work!!! Personal finance blog

ReplyDelete

ReplyDeleteMerriam-Webster's meaning of bookkeeping is "the procedure for recording and summing up business and monetary exchanges and breaking down, confirming, and revealing the outcomes."

Financial coach services

we meet with the accompanying tenet of the monetary establishment: primary capacity of the finances is in the fulfillment of individuals' demands; the subjects of practical exercises of any sort (firms, additionally state organs of each level) are coordinated towards satisfying this essential capacity.Bookkeeping Services Mississauga

ReplyDeleteYou should observe the right proficient who has had genuine encounter and aptitude in regards to your specific physical issue or case. how to get the most money from a car accident

ReplyDeletehow to find a personal injury lawyer

What does it mean to you to have a career? Is it just your job? Is it something you do to make a living? Is it what you do for money? Is it your work? worker

ReplyDeleteThe modern world is packed with businesses but do you probably know how important they can be? check here

ReplyDeleteHey what a brilliant post I have come across and believe me I have been searching out for this similar kind of post for past a week and hardly came across this. Thank you very much and will look for more postings from you. Best Injury Lawyer Los Angeles

ReplyDeleteOne of the best blog commenting websites. I really appreciate this website for its works!!

ReplyDeletePlease visit my website.

Satta number

Satta Bajar

I high appreciate this post. It’s hard to find the good from the bad sometimes, but I think you’ve nailed it! would you mind updating your blog with more information? nft art finance twitter

ReplyDeleteRegardless of whether you are more modest or start-up firm searching for data on the most proficient method to get a business advance or a bigger set up firm searching for development financing or securing open doors we're featuring 3 slip-ups that business advance searchers like your organization need to abstain from making while tending to, obtaining and arranging your income/working capital and business financing needs.https://www.buyyoutubeviewsindia.in/youtube-marketing/

ReplyDeleteComprehend the genuine state of your organization finances - These are quite often effective tended to when you invest energy on your financials and see how your budget summaries mirror your admittance to business advances and business credit overall. Loan Shop UK Under 61

ReplyDeleteHow far back truly relies upon how aggressive your watchwords and market is. It very well may be a couple of positions, or as much as a couple of pages.https://onohosting.com/

ReplyDelete

ReplyDeleteIt doesn't help their own or business connections to have mind-sets that are flighty, or to be peevish and anxious.

cheap website hosting

However it will be not too intense as it was during recession period. warehouse space to lease

ReplyDeleteThis is one of the most misconstrued Laws of Life because of the conviction that all situation are fated to come to pass because of some past activity. https://brooklyn-injury-attorneys-pc.business.site/

ReplyDeletebrooklyn injury lawyers

Really a great addition. I have read this marvelous post. Thanks for sharing information about it. I really like that. Thanks so lot for your convene. finance tips and tricks

ReplyDeleteI can set up my new idea from this post. It gives in depth information. Thanks for this valuable information for all,.. personal finance tips

ReplyDeletewhen the worth is understood and concrete efficient types of the acknowledged worth are isolated from the consistence of the benefit". V. M. https://www.buyyoutubesubscribers.in/

ReplyDeleteGreat write up on personal finance, I really found this blog very informative for my study as well. i am doing my distance certificate course in fiance and this was very useful blog for me, keep sharing.

ReplyDeleteLots of small enterprises operate without budgets. Many small companies which do have budgets aren't getting all the out of them as they quite simply could. This information explains the whys and hows. navigate to this web-site

ReplyDeleteA homeowner can apply for a personal loan for any purpose vacation, home improvement, car finance, education.작업대출

ReplyDeleteNice post, its a really cool blog that you have here, keep up the good work, will be back.Best Mortgage Rate in NewmarketBest Mortgage Rate in Newmarket

ReplyDeleteVery informative article. Really looking forward to read more. Want more.

ReplyDeleteStock Market Training in Ameerpet

the airtcle is nice, gain a Vintage Car Plate

ReplyDeleteWhat is Mortgage Default Insurance and how much will it cost you? See how Mortgage Default Insurance rates vary by down payment levels and paying back periods. Mortgage Default Insurance Calculator

ReplyDeleteIf decline the relational word "communist" in the meaning of finances, we might say, that it actually keeps reality. We meet with such customary meanings of finances, without a descriptive word "communist", in the advanced affordable writing. NFT Droppers

ReplyDeleteThe information you've provided is quite useful. It's incredibly instructional because it provides some of the most useful information. Thank you for sharing that. Credit Card Debt and my Credit

ReplyDeleteFinding Car Accident Lawyer in Canada? So VSR Law can assist you in recovering damages and ensure that your Motor Vehicle Accident claim is as strong as possible. Car Accident Lawyer

ReplyDeleteThank you for the information you have provided, this is very helpful, and the discussions here are very exciting. Current Mortgage Rates Calgary

ReplyDeleteCool

ReplyDelete