MONEY: Top 10 Financial Tips for Parents (2017)

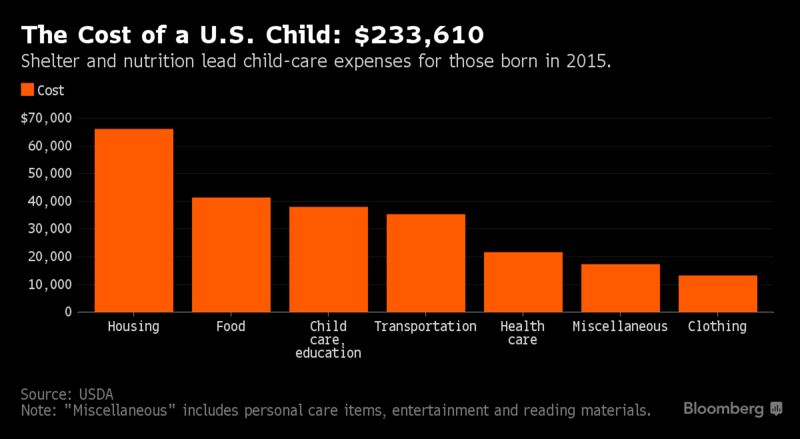

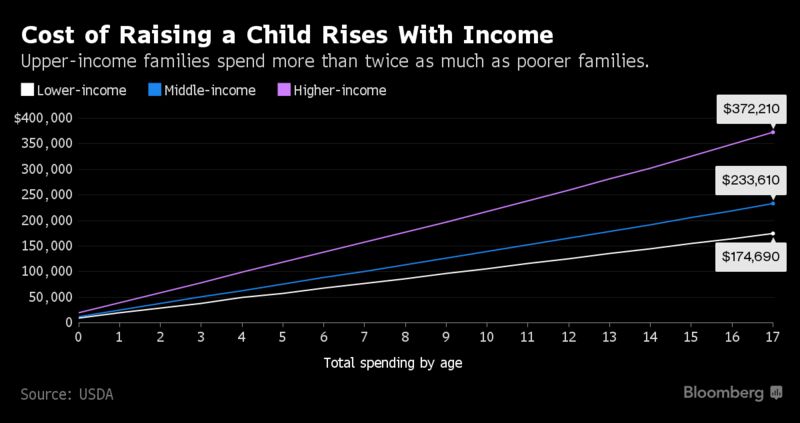

When I was single, it was hard to comprehend just how much expensive it is to raise a child. I never had much reason to walk down the baby aisle at the grocery store to look at the prices for diapers, formula, etc let alone worry about how much daycare and baby sitter bills would be down the road. Once my wife and I started planning on having our son, all that changed as we started to plan and budget for parenting costs. As a relatively new parent (my son will be 4 years old in the next two months), the current government estimate of $233,610 for the first 18 years of a child's life seems like it's a bit low. Come to find our that estimate includes housing, food, transportation, and clothing (Money), but does not include payments for college or financial contributions from non-parental sources (Bloomberg) which can add up rather quickly.

(Image courtesy of Money)

Whether you're already a parent, expecting a child, or just curious about what kind of financial issues you need to be aware of in modern day parenthood, it's essential to start getting your plan laid out. I can tell you from personal experience that these tips are great for getting started, but also great for helping to assess financial decisions for your household on a monthly and annual basis. Plans and budgets change over time and with different circumstances, but we all want our kids to be healthy, happy, and comfortable. One of the best ways of ensuring that our kids have it just as good or better than we did growing up is to take advantage of all the great information that is available and apply it to our everyday lives.

To watch a video with financial advice for parents from Time Money, click here:

Here are 10 Financial Tips for Parents:

1. Create a Budget to Ensure that you're Spending Less Than You Make

Go over your monthly spending to find savings. Ask your wireless and cable providers to "audit" your bills. Contact insurers about discounts and raising your deductibles. Cancel subscription services you're not really using. Often, just tracking your spending can save hundreds of dollars (Fidelity).

2. Create a Will and Appoint a Guardian

While it is difficult to imagine not being there for your child, it is extremely important to have a will and especially to name a guardian. And not just any guardian - the right guardian. Someone who would be able to give the love and support you hope to provide. Someone who shares your values and can pass them on to your child. Someone who can keep your memories alive. And someone you can trust to carry out your dream of pursuing a secure financial future for your child. Picking a guardian for your child may be the most important decision you make.

Almost as important as naming a guardian is naming an executor - the person who wraps up your affairs, pays bills, and expenses and makes sure your property is transferred to those named in your will. A will allows you to stipulate how your assets will be managed and used to see your child through to adulthood. More specifically, you can use a will to outline exactly how and at what stage of life your children can gain access to whatever money you may leave (Bank of America).

(Image courtesy of Bloomberg)

3. Put a Plan in Place

It's important to know the financial considerations associated with a growing family, including having a plan for both expected and unexpected events. Laying the foundation for a secure financial future for your family starts with having a plan in place.

- Take inventory of your financial resources and revise your budget to account for child-related costs

- Identify any employer benefits - such as adoption reimbursement, flexible spending accounts, 529 college savings plans, or child care subsidies - which you can take advantage of to help cover child-related costs.

- Identify your long-term goals. To help meet future financial needs, consider saving 15% of pretax income for retirement. That includes their contributions and any matching or profit sharing contributions from an employer.

- Enroll in your workplace savings plan as soon as you are eligible and take full advantage of any employer match.

- Reduce or eliminate bad debt such as high interest credit card debt, and establish an emergency fund as a safety net. Try to build a safety net of at least three months of living expenses.

- Save more for retirement and other goals using tax-advantaged savings (Fidelity)

4. Automate Your Savings and/or Debt Payments

Once you've identified your financial goals, you are more likely to make steady progress toward your goals if you set up automatic payments and/or deposits. "By automating your savings or debt payments, you are prioritizing your goals and forcing the rest of your life to fit around them," says Matt Becker, founder of Mon and Dad Money, a financial planning firm serving new parents (CNBC).

5. Create a Shopping Strategy

Shopping for baby is a lot of fun. Throw in "proud papa zeal" and "pregnant mama hormones" and you have a recipe for overspending.

Before you lady down a dime, know your needs and wants, and determine how much you're willing to spend. Pick up a copy of Baby Bargains by Alan and Denise Fields for reviews on hundreds of baby products, and advice on choosing the must-haves and avoiding the probably-nots. You can also read consumer reviews of baby products online. Then, leaving your money and credit cards at home, wander through a baby store just to try the items out - push around a stroller, adjust the straps on a car seat, try setting up a play pen.

Once you've settle on your list, schedule your purchases. You have 40 weeks after all, so there's no reason to stress the checking account try to buy everything at once. A good strategy is to buy things gradually over, say, the last four or five months. (You don't want to buy much until after the fifth month if you plan to find out the sex of the child, or if you have a history of miscarriage). Whether you ultimately buy online of in person, make sure you know the store's return policy. Target, for example, has a 90-day limit on returns, so if you buy something too far in advance and you change your mind after baby's arrival, you could be stuck (Quicken).

6. Don't Have Too Much House

Your home is an emotional topic. It's also likely the largest item in your budget. And for the typical family, it's the largest child-rearing expense, according to the USDA. While you want a home that can accommodate a growing family, beware of over spending for the roof over your head - and the costs of maintaining it.

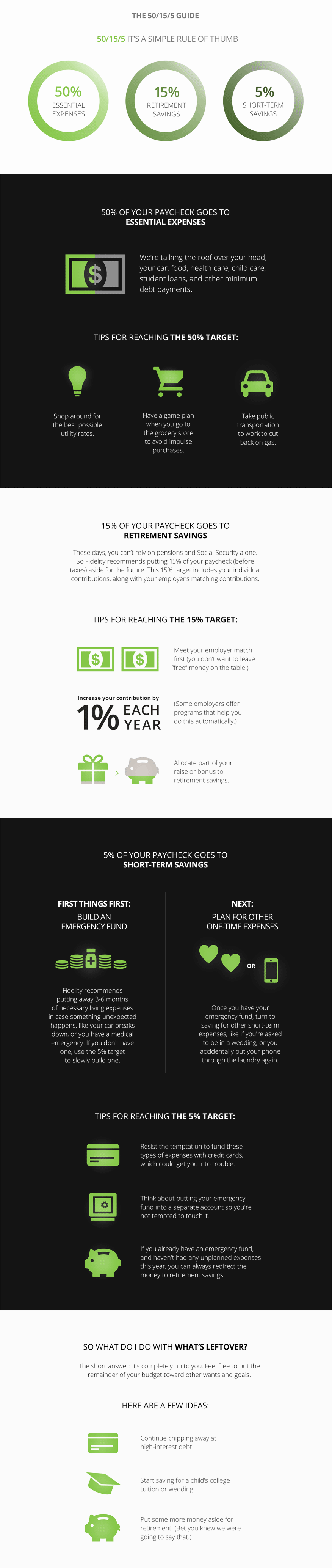

Fidelity's 50/15/5 rule of thumb suggests spending no more than 50% of your take-home pay on essential expenses - housing costs as well as food, health care, and debt repayment. Another way to think of it: Hold your housing cost to about 30% of your monthly income. The U.S. Department of Housing and Urban Development (HUD) considers families who pay more to be "cost burdened"; such families may have difficulty covering other important expenses (Fidelity).

(Image courtesy of Fidelity)

7. Add Your Baby to Your Health Insurance

Make sure to put your child on your health insurance plan within 30 days of his or her birth. Fill out paperwork ahead of time, if you can (Forbes).

8. Have a Fun Budget

Have date nights out with your spouse and take vacations. Consider these investments in your relationship (Forbes).

9. Increase Your Emergency Fund

Having a child raises the stakes for "rainy day" planning. You'll want to be sure you can keep your household running smoothly in the event of job loss, illness, or a large unexpected expense. As a rule of thumb, most financial experts recommend keeping three to six month's worth of essential living expenses readily available for emergencies. This money doesn't have to be in a single account, but can be spread between interest-bearing checking or money market accounts, certificates of deposit, short-term U.S. Treasuries, or other relatively conservative, liquid investments (Schwab).

10. 529 College Saving Plan

According to Joe O'Boyle, financial adviser and retirement coach with Voya Financial Advisors, "Our clients said that having a college fund to put their baby through college 'and hopefully medical school' was extremely important to them. Consequently, we recommended they start saving into a 529 college savings plan. If you open up a 529 account for your child, you retain complete control of the money. Any growth is always federal tax-free and typically state tax-free for college when used for higher education. And should your child be fortunate enough to receive a scholarship, you can transfer the funds to assist another child. Higher education costs are one of life's biggest expenses. Establishing a savings plan early on can help keep parents from dipping into their own retirement funds down the road" (Money).

BONUS: Make Room for Baby in Your Everyday Budget

The startup costs of having a baby may be steep, but don't forget the extra day-to-day costs your little bundle of joy will bring: Diapers, food, clothes, health insurance, photo developing, baby sitters, laundry and even utility bills because you'll probably spend more time at home.

As a rule of thumb, the Consumer Credit Counseling Service suggests you plan on spending at least an extra $200 a month. If you'll need to pay for child care, a bigger house or a new minivan, you'll need to budget more. Examine you budget to identify areas where you can cut back to make room for the extra expenses (Quicken).

Did you find this article helpful? Please let me know in the comments.

Comments

Post a Comment